Improving each stage of the recruiting lifecycle, including candidate sourcing, engagement, and conversion, is critical for small- and medium-sized businesses (SMBs) like yours to grow.

Before you adjust your recruiting strategy, identify key data related to your short- and long-term hiring efforts that matter most to your growing business. Even in a smaller company, having the people, processes, and technology to monitor these recruitment and hiring metrics is essential.

Let’s review the basics of recruiting metrics, tips for collecting data, and useful recruiting benchmarks to track and explore.

What are Recruiting Metrics?

Recruiting metrics are data points used to track business recruitment and hiring success. They cover various aspects of the hiring process, from time to fill to cost to hire, allowing you to track the effectiveness of your business’s recruiting efforts—how efficient hiring is and whether you’re hiring the right people for your open roles.

Why Tracking Recruiting Metrics Matters

No matter how many people you need to hire or your business’s challenges, ensure you use data-driven insights to guide your hiring efforts. Recruiting metrics enable you to determine whether you’re engaging and onboarding job seekers effectively or if you need to adjust your approach.

Tracking talent acquisition (TA) data regularly isn’t just important for your HR team—it can also help your business leaders make more informed decisions about adding resources in the company. After all, your leaders want to know which processes are efficient, effective, and contribute to long-term growth, so they can allocate resources accordingly.

When you know where recruiting bottlenecks exist, you can make changes that drive down recruitment costs, streamline the application process, and improve candidate outreach.

Best Practices for Collecting Recruiting Metrics

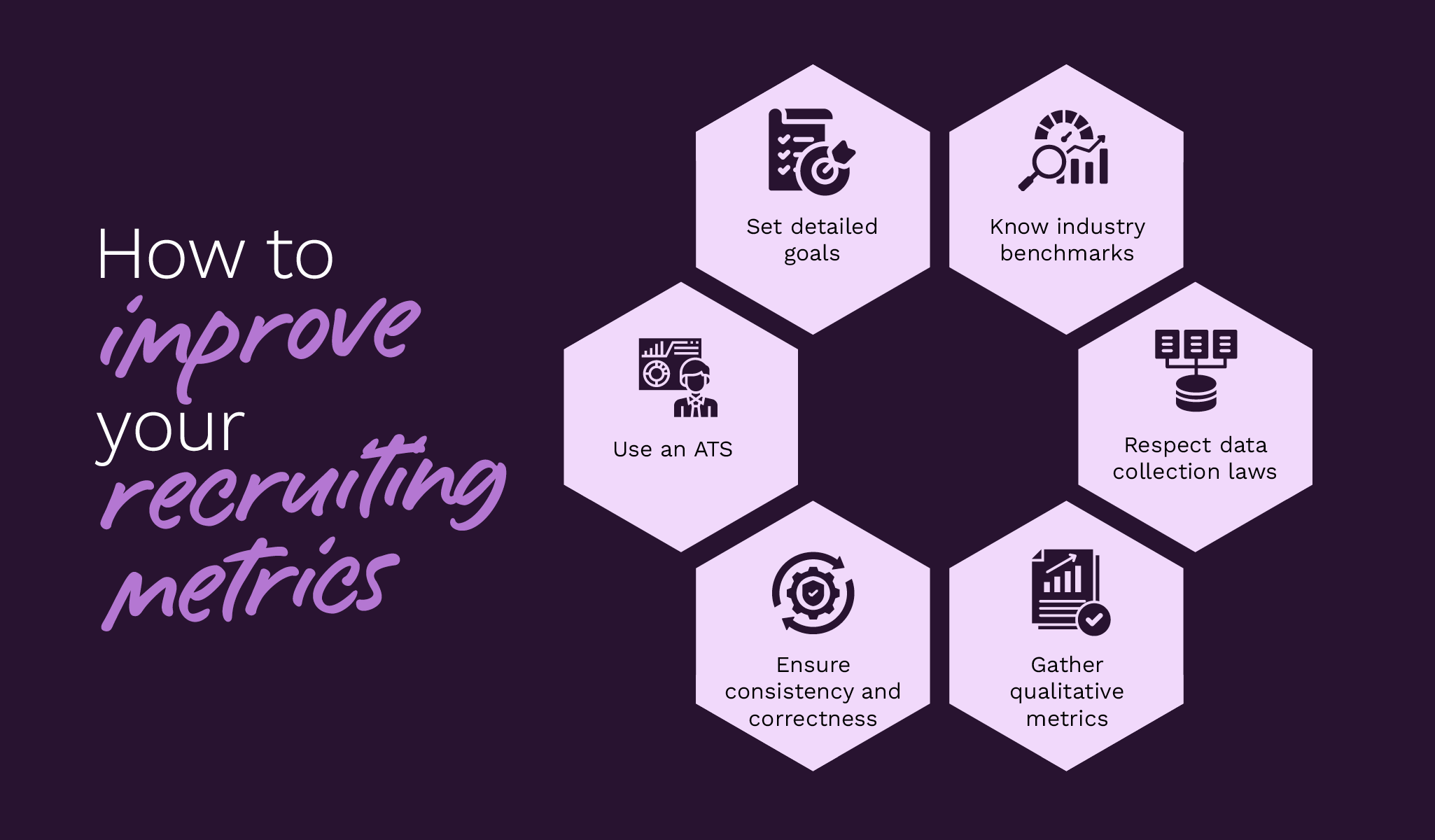

Here are a few best practices for simplifying recruitment data collection:

- – Use an applicant tracking system (ATS). Regardless of your SMB’s size, an ATS like JazzHR can help your company source qualified candidates, provide a positive application experience, and improve your employer brand.

- – Set detailed goals. Ensure your team’s goals follow the tried-and-true SMART (specific, measurable, attainable, realistic, and time-bound) framework, so you can easily pinpoint relevant metrics.

- – Ensure consistency and correctness. Maintain consistency in your collection methods and criteria, and regularly audit your data to correct any discrepancies.

- – Know industry benchmarks. As you start setting recruiting metrics, research within your industry to see which metrics have worked for similar businesses.

- – Gather qualitative metrics. Don’t just focus on the numbers. You can gain valuable, nuanced insights by asking for qualitative data, such as comments about your recruitment process or perceptions of your employer brand.

- – Respect data collection laws. Thoroughly research and implement practices that align with data privacy best practices and regulations, such as transparency and security.

As you start collecting, analyzing, and acting on recruiting data, it might take some time to fall into a natural cadence, especially if you’re working with a small team. Regularly audit your processes, so you can bridge any gaps and work better together.

Let’s explore key recruitment metrics that can give you insight into the strengths and weaknesses of your SMB recruiting efforts.

Critical Recruiting Metrics Your Hiring Team Should Monitor

Let’s explore key recruitment metrics that can give you insight into the strengths and weaknesses of your SMB recruiting efforts.

Average Cost of Hire

- – Basic definition: The measure of how much money your business typically spends on recruiting a single hire.

- – Why it matters: Tracking the expenses designated to promote an open position can ensure you don’t waste any resources. Also, this is one of the most important recruiting metrics for SMBs, given the limited budget you might have for paid recruitment marketing activities. Your internal and external recruiting costs can add up quickly if you don’t pay close attention.

- – Suggested next steps: Compare your cost to hire with other industry benchmarks, which take into account your industry, job level, company size, geographical location, and more. Based on this comparison, consider which parts of your hiring process are more costly and how you can adjust them.

Time to Fill

- – Basic definition: How quickly it takes you to find and hire a new candidate for an open role.

- – Why it matters: You may not have more than a few total open positions at any given time. However, that doesn’t mean you should take a long time to source, nurture, and interview talent. Instead, move with a sense of urgency to drive down your average time to fill to ensure you can fill roles in a timely manner.

- – Suggested next steps: If your average time to fill is longer than you’d like, take a closer look at which parts of the hiring process may be dragging. Identify key blockers to the recruiting funnel and work to streamline them—for example, does your recruiting team take a while to start conducting outreach once a new role opens up? Or maybe your team takes a while to initially screen candidates based on their resumes?

Time to Hire

- – Basic definition: How quickly you move a candidate through the recruiting funnel, from the moment they are approached to the moment they accept an offer.

- – Why it matters: Similarly to the time to fill metric, moving with a sense of urgency shows your business’s leaders that you can fill roles in a timely manner. However, time to hire also reflects a key part of the candidate experience. If it takes you a long time to send an offer to a candidate, they may grow impatient or frustrated with your application process.

- – Suggested next steps: When onboarding new hires, survey them about their experience during the application process. Ask them how they felt about the speed of your recruiting team’s responses and the general pace of your hiring. If they indicate that they felt the process was too long, then you may need to make adjustments to improve your time to hire.

Application Completion Rate

- – Basic definition: The measure of how many candidates started an application and finished it.

- – Why it matters: Clunky or complicated application processes that require account setup and log-ins lead to few completions by active job seekers. Conversely, simple, user-friendly application processes that take just a few minutes often lead to higher application completion.

- – Suggested next steps: If your application completion rate is low, take another look at your application. Consider how you can simplify it or if there are any fields that you could remove. For example, for a lower-level position, you could remove the requirement for a cover letter to remove a large barrier to application competition.

Applicants Per Opening

- – Basic definition: The number of applicants that apply to any one opening at your business.

- – Why it matters: This recruiting metric provides a way to measure how enticing your job openings are in the market. If there are many applicants, many individuals want that specific job or to work at your specific organization. If there aren’t many applicants, your job opening may fall short of similar roles in other organizations.

- – Suggested next steps: The number of applicants per opening is impacted by various factors, from your employer brand to the compensation you offer. Use this metric as a signal to dig deeper into your other recruiting metrics to determine if there’s an issue with your hiring processes, or if it’s just a sign of greater economic patterns.

Offer Acceptance Rate

- – Basic definition: The measure of how frequently the offers you extend to applicants are accepted.

- – Why it matters: You need to know the rate at which candidates you interview and advance to the offer stage decide to join your business. If your offer acceptance rate is low, you must find out why your offers are lacking to ensure that hiring continues to go efficiently.

- – Suggested next steps: Direct feedback from potential hires through post-interview candidate experience surveys can reveal why they did or didn’t accept an offer. This can be used to change your recruiting approach for certain roles.

Sourcing Channel Effectiveness

- – Basic definition: The platforms or channels that yield the most and best new hires.

- – Why it matters: Not all sourcing channels provide the same return on investment. That said, you won’t know whether you should continue looking for passive or active prospects on certain channels if you don’t keep tabs on how many leads you secure and how far they advance in your hiring process.

- – Suggested next steps: Look at high-performing recent hires (within the last two years) and explore which channel they were sourced from. If you see any patterns (for example, if most of your best hires are from LinkedIn), then focus your hiring efforts on these channels for better results.

Sourcing Channel Cost

- – Basic definition: The cost of using and maintaining a sourcing channel.

- – Why it matters: Certain sourcing channels may cost more to utilize than others. You want to make sure that you’re using your money wisely, not spending on less effective sourcing channels.

- – Suggested next steps: Consider a sourcing channel’s cost against how many applicants it brings in and how many of those applicants end up hired. If there are any channels that you’re heavily invested in but that aren’t working for your needs, consider pulling back the spend on it. Conversely, if a sourcing channel is extremely effective but you’re not spending much on it, consider upping your investment to bring in more top talent.

Funnel Conversion Rates

- – Basic definition: Metrics that reveal how far prospects advance from stage to stage in your recruiting funnel, such as application to interview rate.

- – Why it matters: Tracking funnel-based metrics to see how far the average candidate makes it in the recruitment lifecycle can help you pinpoint areas for improvement in your candidate relationship management approach.

- – Suggested next steps: Explore if there are any parts of the funnel that candidates tend to stop at. Then, discuss with other hiring team members to brainstorm ideas that will help candidates continue moving forward from that funnel step.

Nurture Engagement Levels

- – Basic definition: The open, click, and response rates of candidate nurture messaging.

- – Why it matters: Whether you deliver emails, texts, or a mix of both to candidates, you need a mechanism to easily and efficiently analyze your candidate engagement across channels to see which approaches work best and should be used most often.

- – Suggested next steps: If your nurture engagement levels are low, look at specific messages where engagement rates were higher than average. Analyze them for what makes them more engaging and effective than your other messages. Take these insights and apply them to future messaging to boost engagement levels.

Candidate Feedback Scores

- – Basic definition: Ratings provided by candidates about your recruiting process.

- – Why it matters: Compiling candidate feedback can give you rich insight into the external perception of your SMB recruitment model. Aside from securing general comments from prospects, it’s equally important to collect specific ratings from candidates, so you can quantify your work—and make the necessary adjustments to provide a better candidate experience over time.

- – Suggested next steps: If you aren’t already, send surveys to candidates and ask them about their experience with your hiring process. Based on their responses, make the necessary adjustments to ensure you deliver a great candidate experience during your hiring process.

Hiring Manager Satisfaction

- – Basic definition: The measure of how satisfied the hiring manager is with the outcomes of the hiring process.

- – Why it matters: Feedback is essential for understanding the nuances of your recruiting process. As with candidate feedback, it’s helpful to gather feedback scores and qualitative comments from your hiring team that help you tangibly measure your effectiveness.

- – Suggested next steps: Have your hiring team fill out a survey about how satisfied they are with your process. Then, schedule a team meeting where you discuss the survey responses and how you can make improvements to talent acquisition.

Quality of Hire

- – Basic definition: The ratings of new hires by managers several months into the job.

- – Why it matters: A high quality of hire indicates an employee you hired is performing well in the job. However, a low-quality hire who has poor reviews and misses target goals can greatly hinder your company’s success.

- – Suggested next steps: Evaluate candidate profiles for high-quality and low-quality hires for any commonalities or shared characteristics that might explain why they were high- or low-quality hires. Use that information to develop your talent acquisition further. For example, if most of your low-quality hires have little to no prior experience in the industry, begin adding an industry experience requirement to your job listings.

Employee Retention Rate

- – Basic definition: The measure of how many of your employees remain at your business over time.

- – Why it matters: Employee retention rate is another post-hiring metric that reflects the ROI of your recruitment team’s strategies. A high retention rate indicates members of the workforce you helped hire are satisfied and want to stay, meaning your recruitment efforts are reaching the right audience.

- – Suggested next steps: If your retention rate is low, evaluate your workplace culture, benefits, and engagement programs to ensure you’re delivering a quality work experience. Conduct exit interviews to understand why employees are leaving, and consider their feedback as you adjust your talent acquisition process.

Tracking Recruiting Metrics with JazzHR

To properly track recruiting metrics, you need a robust ATS that caters to the unique needs of growing companies like yours. One of the best options available today is JazzHR. With affordable pricing tiers and a comprehensive, intuitive interface, JazzHR makes it simple for SMB teams to track relevant recruiting metrics.

To learn more, explore our solution’s capabilities with your free trial today.